Aside from the revenue recognition principle, we also need to keep the accounting principle of conservatism in mind when dealing with unearned revenue. The goods or services are provided upfront, and the customer pays for them later. Although they sound similar, unearned income and unearned revenue aren’t the same thing. It’s important to distinguish between them, since they’re treated very differently for accounting purposes. The accounting principle of revenue recognition states that revenue needs to be recognized when it’s earned, not necessarily when payment is collected.

SolarBank Announces Third Quarter Results and Provides Year-End Revenue Guidance – Yahoo Finance

SolarBank Announces Third Quarter Results and Provides Year-End Revenue Guidance.

Posted: Tue, 30 May 2023 07:00:00 GMT [source]

You will only recognize unearned revenue once you deliver the product or service paid for in advance as per accrual accounting principles. It means you will recognize revenue on your revenue statement in the period you realize and earn it, not necessarily when you received it. Companies are turning to smarter, AI-oriented solutions for recognizing and reporting revenue, such as ProfitWell Recognized. In accounting, unearned revenue has its own account, which can be found on the business’s balance sheet.

Is unearned revenue debit or credit?

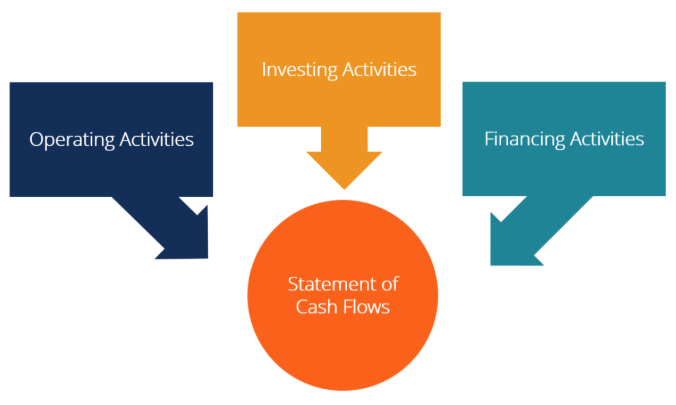

Since the deliverable has not been met, there is potential for a customer to request a refund. Businesses can profit greatly from unearned revenue as customers pay in advance to receive their products or services. The cash flow received from unearned, or deferred, payments can be invested right back into the business, perhaps through purchasing more inventory or paying off debt. Unearned revenue is a liability for the recipient of the payment, so the initial entry is a debit to the cash account and a credit to the unearned revenue account. As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the balance in the revenue account (with a credit). The unearned revenue account is usually classified as a current liability on the balance sheet.

This type of revenue, for one, provides an opportunity to help small businesses with cash flow and working capital to keep operations running and produce goods or provide services. However, understanding how unearned revenue impacts the books and customer relationships is key to making the most out of this financial component. On January 1st, to recognize the increase in your cash position, you debit your cash account $300 while crediting your unearned revenue account to show that you owe your client the services.

How does the accounting for unearned income or revenue work?

Both are balance sheet accounts, so the transaction does not immediately affect the income statement. If it is a monthly publication, as each periodical is delivered, the liability or unearned revenue is reduced by $100 ($1,200 divided by 12 months) while revenue is increased by the same amount. Once goods or services have been rendered and a customer has received what they paid for, the business will need to revise the previous journal entry with another double-entry. This time, the company will debit its unearned revenue account while crediting its service revenues account for the appropriate amount. Unearned revenue and deferred revenue are similar, referring to revenue that a business receives but has not yet earned. However, since the business is yet to provide actual goods or services, it considers unearned revenue as liabilities, as explained further below.

Is unearned revenue a current liability?

Unearned revenue is an account in financial accounting. It's considered a liability, or an amount a business owes. It's categorized as a current liability on a business's balance sheet, a common financial statement in accounting.

Companies that use the accrual method of accounting are required to record accounts receivable definition. This is a particularly important requirement for any large publicly-traded company. We see that the cash account increases, but the unearned revenue liability account also increases. The recognition of unearned revenue relates to the early collection of cash payments from customers. An easy way to understand deferred revenue is to think of it as a debt owed to a customer. Unearned revenue must be earned via the distribution of what the customer paid for and not before that transaction is complete.

Expert Accounting Tips For Scaling Ecommerce

Unearned revenue is any money received by a company for goods or services that haven’t been provided yet. It’s a buyer prepaying for something that will be supplied at some point in the future. Unearned revenue is a liability because there is a chance of a refund. Remember revenue is only recognized if a service or product is delivered, a refund nulls recognition.

You can also use it to sort and analyze revenue received by criteria or automate amortization schedules. When it comes to owning a successful small business, cash will always be king. Cash is what your business uses to offset its expenses and helps you out during slow seasons.

Is unearned revenue an asset or income?

In summary, unearned revenue is an asset that is received by the business but that has a contra liability of service to be done or goods to be delivered to have it fully earned. This work involves time and expenses that will be spent by the business.